by Jim Scarantino | Nov 10, 2023 | General

What a mess. The $108 million Port Townsend Aquatic Center as proposed to City Council would default in its first year. To calm skeptical taxpayers, numbers are being juggled, massaged and manipulated. Millions of dollars magically disappear from cost entries in order to turn red ink black. Looking closely, one can see there is no money to pay for administration and management during and after construction, thus making the project appear less costly to taxpayers.

But under the pixie dust, above the smoke and mirrors, behind the curtain, the hard, cold reality remains unchanged: economically distressed Jefferson County simply cannot afford something so costly.

Red Ink Turned to Black Ink (Not Quite)

At the same time they were seeking City Council’s endorsement for their proposal, promoters of the aquatic project did not disclose that their calculations showed the aquatic center could default in its first year of operation.

On October 16, 2023, City Council was asked to endorse the proposal from the aquatic center Steering Committee for a $37.1 million aquatic center and county-wide sales tax to pay for it. $22.1 million would be borrowed through a bond supported by sales tax receipts. $5 million, council was told, would be raised by the Jeffco Aquatic Coalition, $5 million from state grants and $5 million from federal grants.

The impressive 30,000 square foot facility being proposed would greet visitors with a high-ceiling, gleaming atrium with expansive glass walls, leading to the natatorium.

There swimmers could choose from the cool water 25-yard, 6-lane competition pool (where their form and speed could be judged by those in bleachers built to hold 100 spectators), or they could dip in the warm water of the 3,000 square foot recreation pool, where they could also walk against the artificial current of a “lazy river” feature. Afterwards, they could kick back in the $106,000 whirlpool/spa.

On other occasions, they could rent out the “birthday room” or knock around a ball on the new pickleball courts outside. There would be very nice universal locker rooms, showers, offices, storage space and parking for about 130 vehicles.

Of course, neither the city nor the county has the money on hand to build this facility. Money must be borrowed — $22.1 million, according to the “final” report.

In our previous reporting, we examined the pro forma upon which the Steering Committee was operating. A pro forma is a projection of annual debt service payments (principal and interest) versus expected revenues from the new county-wide sales tax the committee is proposing. Its purpose is to determine if the bond can be repaid.

The city’s own analysis showed that the project would default its first year. Sales tax revenues would not be adequate to pay the project’s debt. The specter of default loomed even though the pro forma assumed a pollyannish interest rate of 4.5% — something we won’t likely see again for years.

The Steering Committee, City Manager and its Parks and Recreation Strategy Director knew this when they sought City Council’s endorsement of their proposal on October 16. I noticed that in the 316 pages of the Report and its appendices in council’s “packet,” there was no pro forma to show if the project could shoulder the debt load they were proposing. In all those pages not even a cumulative interest amount was stated. That is an important number.

In calculating the actual cost of the project, there’s more to it than just the construction costs. The cost of borrowing money must also be considered. That simple calculation was omitted from the material presented to City Council.

So I asked for it. Carrie Hite (Director of Parks & Recreation Strategy) sent the pro forma to me, accompanied by an email in which she wrote: “You ask some great questions and the pool’s financial viability is something we continue to explore.”

This was October 18, two days after the “Final Report” had been submitted to City Council with a request for their endorsement. I then wrote the article reporting that the city’s own internal analysis showed the aquatic center unable to pay its debts and going into default its very first year.

After that report, city staff and the Steering Committee got to work to come up with a more attractive financial picture.

They made stuff up.

What they did was run several new pro formas at 5.5% interest, since their unrealistic 4.5% rate was so obviously invalid. 5.5% is still a very favorable interest rate for a project like this. As of this writing, investment grade 30-year municipal bonds might merit that rate.

But the bond for the aquatic center could very well not enjoy that coveted rating and would have to offer a higher interest rate. How much higher is difficult to say as each bond would be priced according to its individual risk characteristics, and would not enjoy the benefit of a bond agency’s screening and rating.

Consider this: the bond would be floated by a brand-new Public Facilities District (PFD), with no track record, no assets, no money in the bank, nothing in the way of collateral.

The cost of the proposed aquatic center is so large and squeezed so tightly into the limitations of the county’s tax base there are no reserves. If there is a year when the economy hiccups, if costs shoot up unexpectedly, if something big breaks, if the aquatic center does not see the very optimistic 800% increase in use required the first year of operation — there is no cushion, no way to pay bills and no way to meet debt obligations.

This would be a risky bond for investors.

It would be a revenue bond, which would carry a higher interest rate than a general obligation, levy-guaranteed bond paid with property taxes. As the Municipal Research and Service Center explains, “Revenue bonds are not backed by the full faith and credit of the city, and therefore investors consider them somewhat less secure than general obligation bonds. As a result, the interest rate that bond buyers demand may be higher than those on general obligation bonds.”

It will also likely have to be guaranteed by the city or county. It is highly unlikely that anyone will hand over $22.1 million to an untested group of people with no security for the loan other than a guess at future sales tax receipts. Without the city or county putting their assets behind it, this bond could well be rated as below investment grade. That means creditors would demand to be paid a higher interest rate in exchange for accepting more risk.

Enough for a lightning primer in public finance. Let’s look at how $2.1 million has to disappear to turn red ink black.

In response to another request, Carrie Hite provided the latest pro formas they have been considering. You can open the PDF here.

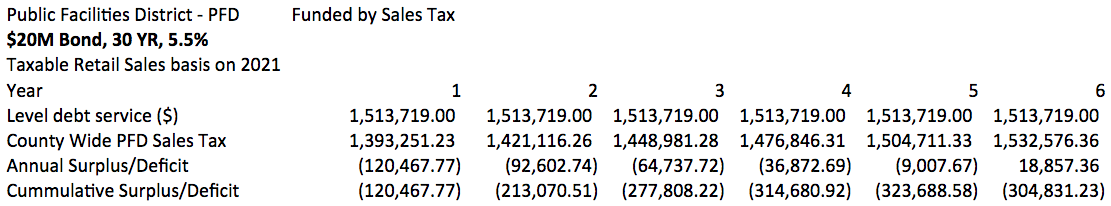

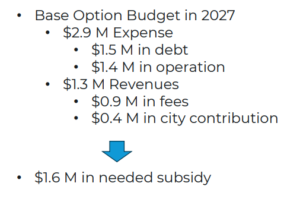

The first 6 years of red ink from the Aquatic Center’s latest pro forma. Note “$20M Bond” is a typo in the city’s pro forma, which should read “$22.1M Bond, 30 YR, 5.5%”.

Now you see it, now you don’t.

There is no way the proposal submitted to City Council can work. Not at 4.5% interest over 25 years, as we have reported. And definitely not at 5.5% interest, when the deficit would swell to more than $246,000 in the first year!

The Steering Committee looked at stretching out the term of the bond to 30 years in the hope periodic payments would be affordable. That won’t work, either. The first year shortfall would still be more than $120,000, as shown in the image above.

So what they did was reduce the amount of money to be borrowed by $2.1 million, stretch out the term of the loan to 30 years and cross their fingers as they sat back and waited for Excel to do its thing. Voila! There’s enough money to make it work — just barely.

They’ve also played with cutting the amount financed to $17 million so the numbers look better.

But this project will still cost $37.1 million to build. It has not been redesigned. Nothing’s been cut. Where will that $2.1 million or $5.1 million in savings come from?

Manna from Heaven

In the “Final Report” (now you understand why we have put that between quotation marks) the Steering Committee told City Council they hoped to raise $15 million, with $5 million each coming from gifts, state grants and federal grants. Maybe now they will tell officials and taxpayers they are going to raise even more in order to have to borrow less. So where are those extra millions going to come from?

Regarding those state and federal grants, the minutes of Steering Committee meetings, found at the end of the appendices to the Final Report, are vague at best on this subject. “Maybe,” “could,” and “perhaps” are used a lot. The only state grants discussed are for work outside of the pool, like for a gym. But there is no gym in the proposed design. There is no state grant for building a pool mentioned in the minutes.

The federal grants discussed would only be for seismic resiliency, that is, covering the additional cost of building stronger for earthquakes. But minutes also reveal that the cost of adding seismic resiliency has been shown to exceed the extra money grants contributed in previous projects.

So much for the certainty of state and federal grants.

So maybe wealthy, generous people will give not only $5 million, but go as high as $7.1 million, maybe $10.1 million.

You Go First

The Jeffco Aquatic Coalition has shown no evidence it has raised $10,000, let alone $10.1 million for the aquatic center. According to minutes of the steering committee, they want a tax measure on the ballot before they start their capital campaign. So far, not enough money to buy some faucets has been raised from private giving or state and federal grants.

There is definitely a rush to get this on an April 2024 ballot.

They want taxpayers to go first. Raise taxes, start making most things more expensive in Jefferson County — from Amazon purchases to socks to home construction and improvement — and then they will start trying to get the rest of the money.

So what happens if taxpayers across the county agree to pay higher taxes, the taxes kick in, but the rest of the money needed doesn’t come through?

Seriously, what happens?

Umm, Didn’t You Forget Something?

The budget in the Final Report maxes out all possible sales tax revenue. The numbers are so tight there is no debt or operating reserve. As we have reported, we are being told that the operating costs for the proposed PT Aquatic Center will be about 40% lower than the comparable experience of the Shore Aquatic Center in Port Angeles, which sees about $2 million a year in operating expenses.

Hite suggested in The Leader that the difference in operating costs can be explained by the Shore Aquatic Center having four “tanks” or pools — a competition pool with diving area, a spa/whirlpool, a wellness pool and an activity pool with a “lazy river.” Port Townsend’s aquatic center would have only two, she said.

Actually, PT would have three pools: competitive, warm water with the “lazy river” and whirlpool. Both facilities have almost exactly the same square footage. The PT Aquatic Center would have a sauna, as does the Shore facility. One could predict that the design of the PT facility would be more expensive, with its higher roof line and graded slope, than that of the Shore center.

Regardless, having an additional small pool, the wellness pool, is only a difference in construction costs, not operating costs, and certainly does not explain how the PT Aquatic Center could operate on $742,000 less than the Shore center. Most operating costs are labor. As discussed below, the fact that there is no provision for administration and supervision of the PT Aquatic Center may go a long way to explaining why its projected operating costs are so low. If operating costs inch up just a bit, the PT Aquatic Center ship capsizes.

A closer inspection of the feasibility study provides some answers. We can see what’s been carved out so the PT facility will have lower operating costs than its counterpart not far away.

For one thing, the Shore facility has an executive director. He interacts with the board, manages the tax revenues and grants, oversees state-mandated audits and reporting, responds to public records requests, etc. He oversaw the $20 million upgrade and expansion in 2020. He supervises the facilities manager, head lifeguard, maintenance crew — everything from physical plant to hiring and firing to dealing with the public and government agencies. He has support staff to help him in this essential work.

The budget for the proposed “base” PT aquatics center, on the other hand, not only does not provide for an executive director, bookkeeper and other support staff, it does not even provide funding for a facility manager. (See p. 55 of Ballard*King feasibility study).

- Shore’s 2023 financial reports shows $158,500 in salaries for administrative staff. The PT Aquatic Center budget is zero.

- Shore spends $112,000 on its Front Desk supervisor and crew; the PT Aquatic Center is budgeted for only $66,378, with no supervisor.

- Shore’s budget also includes salaries totaling $118,700 for janitorial and maintenance versus the PT Aquatic Center’s budget of only $71,868.

- Shore sees janitorial and maintenance expenses for its new facility at the annual rate of $33,200; the PT Aquatic Center budgets only $18,000.

- Shore has learned its insurance costs $93,900 annually; the PT Aquatic Center budget is only $20,000.

- Shore spends $71,100 on childcare; the PT Aquatic Center budgets nothing for childcare.

- Shore has learned from experience to budget $190,000 for materials needed to maintain and repair its 3-year old facility; the PT Aquatic Center budget is only $18,000.

The unexplained discrepancies go on and on until the PT Aquatic Center is budgeted to operate at about $742,000 less annually than the comparable Shore Aquatic Center.

How can such a large facility be run without anyone in charge?

Answer: local government would provide management and administration and bear the cost.

That is an explicitly stated assumption in the Ballard*King budget. (See p. 46). Accordingly, no costs associated with administration are entered into the aquatic center budget; these costs would be off the books in a local government budget. But neither the city nor county governments are going to manage the aquatic center. The city that is heading over a “fiscal cliff” certainly doesn’t have the money.

It is being suggested that the YMCA will manage the facility. But there is no money anywhere in the budget to pay the YMCA.

And who, pray tell, is going to build the new aquatic center?

Not the city. Not the county. It will be a brand new agency called a Public Facilities District (PFD).

This new agency will have to complete the design, engage architects, engineers, put together bid packages, solicit and analyze bids, negotiate contracts, hire and pay construction costs, inspect and approve work and change orders, seek and manage grants, meet state auditing and reporting requirements, comply with public records and open meetings law, serve the appointed board of the PFD, etc. They will need an office, telephones, copiers and lighting so they can see while they work.

The Port Hadlock sewer project needs a crew of about a dozen people to oversee construction.

There is no money in the budget for anyone to get the new aquatic center built and opened!

Even after construction, the PFD will have legal obligations and work that must be done as a governmental entity. But there’s no money to fund a PFD. None.

As If More Consultants Were Needed — Actually, They Are

The Final Report recognizes the work of seven consultants, including a “public engagement consultant.” Missing from the list is a much more critical consultant: the bond, or financial consultant. It is a wise and common practice for public agencies that will be seeking bond financing to engage the services of a bond consultant, such as Northwest Municipal Advisors, who have worked with local governments and public entities in Jefferson County.

They create pro formas using realistic market rates because they work in the bond market every day. They understand that bond financing is very different from, say, mortgage financing. An amortization schedule for a municipal bond will be quite different than the simple pro formas being considered by the Steering Committee. When it comes time, the bond consultant would be the debtor’s negotiator with lenders.

The bond consultant may arrange the short-term bond anticipation note — the equivalent of a line of credit to be used to keep the project going before the funds from the long-term revenue bond are available. That also has been overlooked in the Steering Committee’s calculations.

The interest that would start being due at the beginning of the project will likely be capitalized and rolled into the principal of the long-term revenue bond, raising the dollar value of the amount financed — another omission from the Steering Committee’s calculations, but something a bond consultant would catch.

Then there will be the bond underwriter who raises the capital for the bond.

State law and IRS regulations require engagement of bond counsel. They provide a professional opinion that everything is legal (to oversimplify matters) and that the bond would qualify as tax-exempt.

All of these people have to get paid. Their compensation will come out of a percentage of bond proceeds, which is accomplished by increasing the principal amount of the bond. Thus, a $22.1 million bond would be increased to, say, $22.5 million or maybe more to cover these fees. Taxpayers effectively borrow money to pay these people, as well as borrowing money to pay capitalized interest. That raises the periodic payments and increases the cumulative interest paid over the term of the bond.

None of this is factored into the calculations underlying the “Final Report” and Recommendation — most likely because the Steering Committee spent money on a “public engagement consultant” instead of a bond consultant. The operating and financing costs are thus seriously understated, as PR to sell this to the public was prioritized over crucial bond expertise

The work is hugely incomplete. There are holes in the budget, with necessary items not budgeted, and hopes and prayers plugging the gaping holes. Taxpayers are being rushed into taking the first leap into the murky waters with city councilors being herded into endorsements without getting a complete picture of how bad this thing is.

Cherry Street Project on Steroids

This really is a mess. It is much, much worse than what we saw with the Cherry Street Project. There are so many parallels with what went wrong with what was also a well-intentioned, but fatally flawed undertaking.

Faulty financials:

The Cherry Street Project was created with “bogus” numbers. The feasibility study for the aquatic center, on which everything must stand, is, frankly, garbage. The community is supposed to bet $108 million on the judgment of a consultant who thinks that Mountain View Pool is in Kala Point and Port Ludlow’s pools are on Bainbridge Island. That consultant, as we just discussed, wrote a budget for the aquatic center that has no one in charge.

Like the “bogus” numbers underlying the Cherry Street Project, the bogus numbers underlying the aquatic center are being ignored in a rush to get this on an April ballot.

No unbiased, non-vested confirmation of feasibility:

The Cherry Street Project was pitched and defended by consultants hoping to land a nice contract to execute the project. The same thing is happening here.

Only those who stand to gain a piece of the action — be it Opsis, the architect, or the YMCA — are presenting this project to the public and decision makers. There has been no independent double-checking of the (shoddy) work of the consultants — except by the volunteer citizen journalists of Port Townsend Free Press.

Rush to approve despite warning signs:

There is a rush to just get the money from taxpayers and figure it all out later. We saw this with the Cherry Street Project when hard, cold numbers spoke failure, but city councilors charged ahead out of a sense of haste and not wanting to get bogged down with details or appear to be a dissenter and nit-picker.

If Cherry Street taught a lesson it is this: it is a lot easier to avoid sliding into a project than it is to get out of one.

We were a voice crying in the wilderness when no one wanted to hear of any problems with the Cherry Street Project. Our analysis — which was always based on the very documents and data available to city council and city staff — proved correct. It was a tragedy that the Cherry Street Project ended in such a costly failure and that it dragged out so long.

City officials say they learned their lesson from that fiasco — but have they really?

Seven years later, chalking up a loss of $2 million, the City of Port Townsend has accepted a bid to tear down the never-rehabbed, asbestos-ridden Cherry Street “demonstration project”. That loss pales in comparison to the $100+ million gamble of the proposed aquatic center.

————————————–

For reports on the many other red flags and alarms in the critical feasibility study upon which this shaky edifice is built see:

Drowning in Red Ink: Mountain View Pool and the Proposed Aquatic Center.

Aquatic Center Feasibility Study: It Gets Worse.

The $108,941 Pool Could Default Its First Year.

Related articles:

Mountainview Pool–By the Numbers.

Aquatic Center Beats Out Streets and Core Services in Task Force Report.

by Jim Scarantino | Oct 24, 2023 | General

Eye popping numbers. Red ink from the start. The city’s financial analysis shows that the proposed aquatic center would not be able to pay its debt service for its first four years. That analysis is built upon a fantasy of low interest rates and a Jefferson County that would grow at a steady, uniformly repeated annual increase, uninterrupted and with no downturns, for the next quarter century. Even with these favorable assumptions, default looms.

And where did we get that huge number in the headline? $108,941,000? Are we not being told that the new PT aquatic center would cost “only” $37.1 million?

Read on. Let’s start with the city’s own financial analysis.

Mortgaging the Future

That modest $37.1 million construction project for a new aquatic center will be mostly financed, requiring at least a $22.1 million bond. A bond is the way a government borrows money from investors and financial institutions. Like a mortgage it has a term — the number of years in which it must be paid back — an interest rate, and set periodic payments.

Before a bond is “floated,” that is, sold to investors, an analysis is conducted to determine if the bond will work: will the debtor be able to pay and will creditors get their money on time in the amounts promised? That analysis is called a “pro forma.”

City staff has prepared this analysis on the proposed new pool’s debt. It was provided to us by Carrie Hite, Parks and Recreation Strategy Director. She provided this information without hesitation in response to our request. She has been open and forthcoming throughout this process, it should be noted.

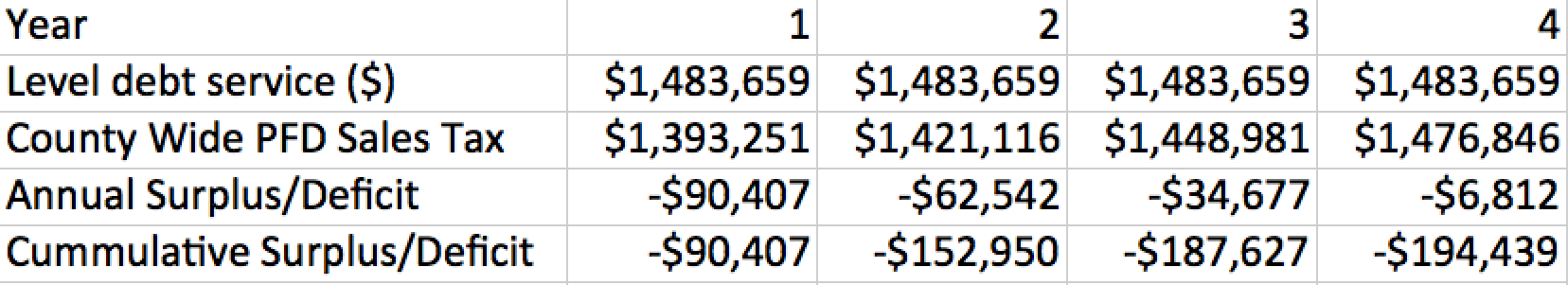

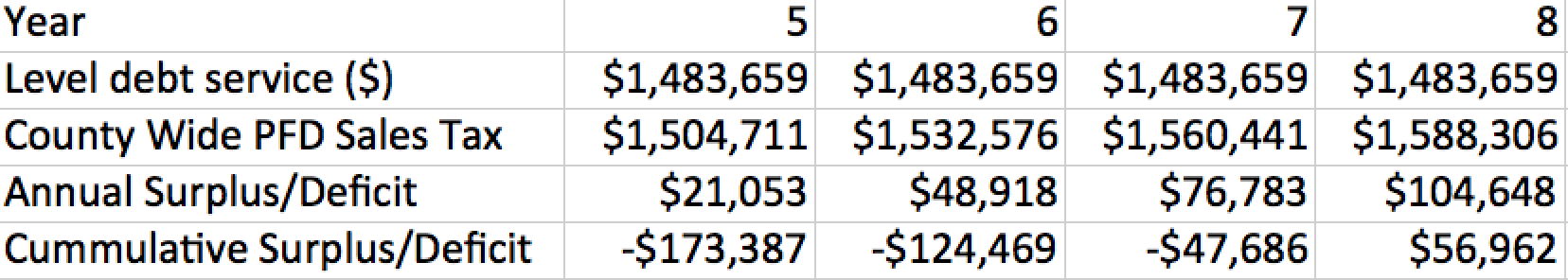

The pro forma — the debt service vs. tax revenue projections — shows this for the critical first eight years:

These figures reflect the annual debt service on a 25-year bond for $22.1 million at 4.5% interest. The “County Wide PFD Sales Tax” shows the estimated revenues from a proposed 0.2% county-wide sales tax that is being considered as the vehicle to pay for a proposed $37.1 million pool. The difference — $15 million — would, it is hoped, come from $5 million each in gifts, federal grants and state grants. “PFD” stands for “Public Facilities District,” a new governmental taxing authority that would own and have control over the pool and which would receive its funding from a new county-wide sales tax.

Sure, this seems slow going. But hang in there. It will soon be clear how the finances for the proposed aquatic center don’t inspire confidence.

Regarding that pro forma — you can put anything into it to make it work, but you should try to be at least a little bit realistic for it to be of any use. This pro forma adds the exact same amount to each subsequent year’s sales tax revenues: $27,865. It is not unfair to say that is an arbitrary number. In the real world, that amount of sales tax revenue would require $13,932,500 in growth in the county’s retail, service and construction sectors every year for the next quarter century, without exception. The sales tax would be 0.2% or 1/500th. Simple math: $27,865, the number added to each year’s projected sales tax revenue total, times 500 equals $13,932,500, the amount the county’s taxable economic activity would have to grow each year.

Is it realistic to assume this steady, constant growth rate, no slowing economy, no bumps, no recession for 25 years? That is what is being done here.

Notice the negative numbers. Right out of the box, in year one, the PFD cannot make its loan payments. It falls $90,401 short. That is considered default. The state of default would continue until year five when, based on those hoped-for constantly rising sale tax revenues, the PFD would finally be able to pay its debt, on account of that arbitrary growth rate we just discussed. But by then, a $194,439 deficit has accumulated. That deficit continues until year eight.

Revenue from user fees at the new pool are not included and do not belong on this pro forma. For one thing, they are wholly speculative. Nobody knows with any certainty how much people will pay to use the new aquatic center.

The consultant’s financial model (that we have critically examined here, here and here) requires the new aquatic center’s revenues to increase by 800% over the Mountain View pool’s revenues starting the first year. But even those hoped-for soaring revenues won’t be enough to cover operating expenses and thus could not contribute anything to meeting debt service obligations. Further, the pool won’t have any revenue its first two years, when the project is being finalized, bid, and constructed.

This pro forma properly analyzes whether a PFD could meet its loan payments from sales tax revenues. It can’t, at least not until five years out. By then — indeed, by the first year — bond investors will be demanding the money they are owed that the PFD can’t repay. Default looms right up front as soon as the project gets going.

This is not the picture of a sensible public undertaking. It brings to mind the Cherry Street Project pro forma which showed that project going into default early on. What should have been a deal-breaker was disregarded by City Council back in 2018.

Will the current City Council — and a Board of County Commissioners, which will have final say on creating the PFD and pursuing a bond measure — fail to heed this recent object lesson in fiscal irresponsibility? Will they charge ahead and ignore the red ink on the wall?

So Much Worse in the Real World

This pro forma used an interest rate we are not likely to see again for years. It arbitrarily employs a 4.5% rate. As of this writing, investment grade municipal bond rates are bouncing between 5.5 and 6%. Some have reached 6.3%.

A bond for a brand-new, untested public facilities district running a pool complex, funded by a variable tax rate, may or may not earn an investment grade rating. It could be viewed as more risky than bonds secured by property taxes or utility rates, charges that must be paid to keep a municipality going. A financially failing pool is expendable in the larger scheme of things. Any lower rating than investment grade means the PFD would have to offer a higher interest rate to attract bond buyers.

If the PFD has to pay higher interest, as anyone who has bought a car or home would understand, its monthly payments will be higher.

Prudence requires considering the worst case, which would be a bond rated below investment grade. But let’s grant investment grade status for this exercise, yet (in compromise) apply one of the highest rates seen the past week. That was 6.3% for a big-city hospital bond, something a lot more solid than a pool bond. (Similarly, Overlake Hospital in Bellevue had to offer 5.85% on its bond that recently went to market.) We will use 6.3% interest over 25 years, the same term being considered now. What does that do to the financial picture?

The red ink gets much worse. Monthly payments would be $146,471 for an annual amount of $1,757,652 compared to the unrealistically low $1,483,659 in the table above. The red ink the first year at a realistic interest rate would amount to $364,401. The cumulative deficit would explode and stretch out until year 14!

Bondholders want to be paid every year. They won’t wait five years for promised payments, and they certainly won’t wait more than a decade.

The $108,941,000 Pool

The 316-page Final Report, Recommendation and Appendices released by the steering committee pushing the aquatic center proposal nowhere states any cumulative total cost for the project. The cumulative interest is never calculated. Nor are operating costs and subsidies ever totaled.

Using the unrealistic 4.5% interest incorporated in the working hypothesis, the total interest over 25 years would come to about $15 million.

Using a more realistic and current interest rate, the total interest paid by taxpayers would be $21,841,000. That is money that would be sent out of this county to institutional investors and wealthy individuals desiring tax-free municipal bond income.

The proposed PT aquatic center would be an almost mirror image of the William A. Shore Aquatic Center in Port Angeles, which reopened in 2020 after a remodeling and expansion. The Shore center has demonstrated it costs about $2 million annually to run such a facility. Over the 25-year term of the PT pool bond — until it is paid off — operating costs, not adjusted upward for annual inflation, would be $50 million.

Let’s add all those certain costs together in order to see the size of the commitment this county would have to make to this pool get the bond paid off and keep the pool’s doors open:

$37,100,000 construction cost +

$21,841,000 in interest payments +

$50,000,000 in operating costs

______________________

$108,941,000 total.

That is a huge number for this small, poorer-than-average county with a housing crisis and negligible income and job growth. No wonder the financial analysis shows this project going into default and failing financially in its first years. The picture gets even worse when real-world financial considerations — not rosy hypothetical assumptions — are applied.

“Speculative”

The steering committee’s fundraising consultant says the last piece in the financial picture is “speculative.”

ECONorthwest of Portland, Oregon, was hired to determine if the county’s economy is strong enough to support this huge project. They determined that the city’s economy could not generate the sales tax revenue to make it come close to working. So the entire county would have to be taxed to find enough money. The ECONorthwest report can be found starting at page 116 of the Final Report, Recommendation and Appendices.

“Capture areas” outside city limits would have to be tapped for tax dollars. The description “capture areas” comes from Jim Kalvelage, the founding principal of Opsis Architecture, the lead consultant on the project. He used that phrase in presentations explaining where the money for the pool would come from since the city’s own resources are inadequate. His included areas such as Chimacum, Port Hadlock, Marrowstone Island, Irondale, Kala Point, Cape George, Gardiner and Discovery Bay. For purposes of the city getting the money it needs, these are the “capture areas.”

At the time, Kalvelage was talking about hitting those areas with a property tax to pay for the pool. Now he and the steering committee are talking about a county-wide sales tax to pay for the pool. In the steering committee notes, they have also discussed going for both a sales tax and property tax. Washington state law allows a PFD to seek a property tax.

The promoters realized that “capture areas” isn’t exactly an endearing phrase for selling this project to county taxpayers, so it has been cynically converted to “service areas.” Kalvelage and the steering committee know the pool will serve very, very few people outside the city, maybe as few as 34 on a monthly average according to YMCA’s 2022 report on the Mountain View pool.

ECONorthwest concluded that, yes, the proposed pool is too big and expensive for the city to afford and a county-wide sales tax would be necessary. But it also concluded that even a county-wide sales tax would not suffice to pay for this size aquatic center. That is because Jefferson County’s service, retail and construction sectors are not robust enough to generate the necessary sales tax revenue.

A lodging tax would also be required to close the gap, according to ECONorthwest.

The kicker is that a PFD lodging tax can only target those lodging businesses with more than 40 units. In Jefferson County there are just three: Kalaloch Lodge far to the west on the Pacific Coast, and Harborside Inn and Manresa Castle in Port Townsend. Manresa has but 41 units, so it could avoid the tax by mothballing one of them.

ECONorthwest hypothesized an annual lodging tax payment of $500,000 from these three businesses to plug the hole in the pool’s financial picture. But it cautions that large number is “speculative.”

Indeed, it is. To generate $500,000 out of a 2% lodging tax, those three facilities would have to enjoy $25 million in revenue every year from renting rooms and cabins.

That’s $25 million from just three relatively modest lodging businesses. We are not talking Las Vegas-sized hotels here.

Prudent people cautioned by their own consultant that their plans are “speculative” would return to the drawing board. Whether our city council members and county commissioners have the sense to do so remains to be seen.

by Jim Scarantino | Sep 10, 2023 | General

Lowballing costs. The feasibility study for the proposed Port Townsend aquatic center appears to grossly underestimate likely operating costs. Annual deficits may be far worse than being reported to the public. Even greater subsidies — and higher taxes — may be required.

The flawed feasibility study prepared for the city and the PT aquatic center task force relies exclusively on hypothetical numbers.

No on-the-ground research in and around Port Townsend was conducted.

In every scenario, a future PT aquatic center (architect’s conception featured above) would run deficits of around $400,000. And that’s being treated as good news.

We have a comparable facility nearby that could serve as a yardstick in accurately estimating costs for a future PT aquatic center. The William A. Shore Aquatic Center in Port Angeles has real-world data collected from real-world experience of its operations over time.

The consultants chose not to consider the Shore center’s real-world experience on the Olympic Peninsula. We will do it for them — and for the benefit of taxpayers who are being asked to foot the bill.

The William A. Shore Aquatic Center

The Shore aquatic center was built in 1961, two years before the construction of Port Townsend’s Mountain View pool. It has undergone many upgrades and renovations and is now a modern, attractive 30,000 square foot natatorium. It had been owned by the city of Port Angeles until 2009 when voters approved creation of the Shore Metropolitan Park District, which now owns and operates the facility.

The expansion of the facility to twice its original size was completed in 2020. In addition to the original competition pool and diving tank, it now offers a spa, a wellness pool, and an activity pool that includes a “lazy river” and vortex ring. All pools are heated. Other additions include a multipurpose space, universal changing hall and locker rooms, and support spaces for staff and patrons. The enlarged building has a dedicated space for the Splash, Play and Active Recreation for Kids after-school program for children, and an outdoor playground with multiple features above a synthetic turf.

In 2017 voters increased the park district’s debt capacity from $6.5 to $10 million. The $20 million renovation was funded with bonds, state and federal grants and cash reserves.

Here is a video tour of the completed facility:

PT Aquatic Center Feasibility Mixed Up

With Upper Macungie, Pennsylvania

The feasibility study for a new PT aquatic center was prepared by the consulting firm Ballard*King & Associates from Highland Park, Colorado. I have written two articles (here and here) examining flaws and red flags in their report. One of the red flags was that these consultants compared PT’s cost of living and housing expenses to those in Pennsylvania. This, combined with other absurd extrapolations (such as concluding we likely had 1,305 adults playing basketball), led me to wonder if they had mixed up their report for PT with work for another community.

It appears that hunch was correct. The Ballard*King report is now posted on the city’s website. There is no title page. It is entitled “Upper Macungie Report 3.22.23” according to the tab that appears on the search bar when the link is clicked.

Upper Macungie is a rapidly growing township in Lehigh County, Pennsylvania. That township had been doing work on a community center. It appears that the report for Port Townsend was cut-and-pasted, commingled and confused with work for a very different community on the other side of the continent.

Here is that curious page from the study comparing PT’s cost of living to its counterpart in… Pennsylvania:

Now add to these reasons to question the validity of the Ballard*King report indications that their operating expense projections appear to be way off. Shore’s real-world experience shows that running an aquatic center costs a lot more than these consultants are revealing.

We have obtained Shore’s recent financial data from Steve Burke, who has been with the Shore Metro Park District since before the facility underwent its expansion and remodeling. You may study that information at this link: 2018-2023 Shore Aquatic Center Financials.

Lowballing the Likely Costs

of a PT Aquatic/Fitness Center

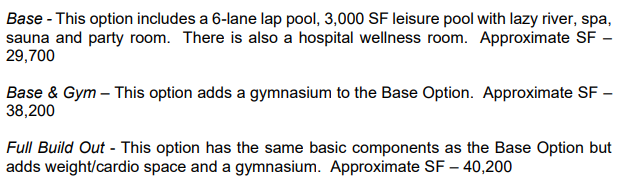

Three versions of a possible new PT aquatic/fitness center have been under consideration. Ballard*King purported to project operating costs for each of them. The three versions are described in their report as follows:

The future PT aquatic center “base” model would be similar in size and offerings to Shore Aquatic Center in Port Angeles. Ballard*King estimated the annual operating costs for Port Townsend’s base model at $1,268,557. This doesn’t square with real-world expenses projected by the already-running equivalent nearby facility. Shore anticipates significantly higher operating costs in 2023.

According to its latest financial data, Shore expects expenditures this year to be close to two million dollars — $1,932,770.

The Ballard*King estimated annual operating cost of $1,268,557 is for a period of time in the future, no sooner than 2026, the year upon which they base their hourly wage predictions. If that figure were adjusted to 2023 dollars, it would be even lower, by a factor that backs out the cumulative effects of inflation.

The current annualized rate of inflation is 3.2%, according to the Bureau of Labor Statistics. If we applied this rate of inflation to adjust the Ballard*King operating prediction figure to 2023 dollars, it would be about $1,191,106 or $741,664 lower than the Shore center’s experience this year. (You can verify this and the following present value calculations using this handy present value calculator.)

How could a similar facility hope to operate in Port Townsend for almost 40% less?

The projected base model is the least expensive version of a proposed new PT aquatic center. At their most recent meeting on August 25, 2023, the steering committee focused on the larger and costlier base-plus-gym and the full build out versions.

The base-plus-gym is projected to cost $37.1 million to build, nearly twice the Shore center’s $20 million expansion and upgrades. Port Townsend, with half of Port Angeles’ population, could thus be building a pool twice as expensive as the one that serves the much larger city. The full build out is projected to cost $45.9 million.

From somewhere, the steering committee believes it will obtain $15 million in grants, gifts or other support for each version, leaving $22.1 million for local taxpayers to shoulder for the base-plus-gym version, and $33.9 million for the full build out.

Ballard*King’s hypothetical annual operating costs for the two larger versions appear to be seriously off when compared to the Shore center’s experience just 45 miles away.

The base-plus-gym version would require, according to Ballard*King, operating expenditures in 2026 dollars of $1,617,810. That is $1,519,036 in current 2023 dollars, compared to the Shore center’s 2023 expenditures of $1,932,770.

How could a larger facility requiring more upkeep and staff incur such significantly lower operating expenses?

The projected operating costs for the massive full build out version — more than a third larger than Shore, with a gymnasium, weight/cardio space and a larger staff — are somehow almost exactly the same in 2023 dollars as the much smaller and simpler Shore aquatic center at $1,957,076 versus $1,932,770.

How could that be possible?

Doesn’t Pencil Out

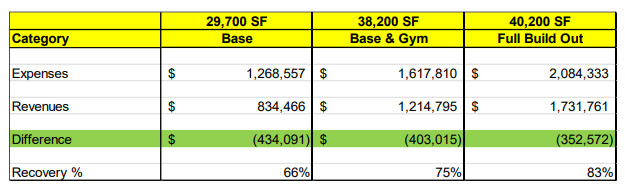

At the most recent town hall presentation, July 13, 2023 at Fort Worden, the public was shown the slide copied above acknowledging that this project can’t “pencil out.” All three versions are projected to run deficits of $352,000 to $434,000, requiring an annual subsidy paid by city taxpayers on top of any property and/or sales taxes they would be paying just for the pool.

Those subsidy estimates may be another instance of lowballing what this project is likely to cost taxpayers.

At a July 2, 2023 workshop — as opposed to a public town hall meeting — the steering committee was provided a much grimmer projection, showing a subsidy of $1.6 million, four times what was presented at the public meetings. Unlike the slides shown the public, this one included the annual financing cost for a new aquatic center:

We’ve Seen This Before:

The Cherry Street Project

“I wouldn’t change a single thing about what we did,” Mayor David Faber has said about the failed Cherry Street Project. The city is now seeking bids to demolish that “affordable” housing project that has taxpayers on the hook for $1.4 million in bond principal and interest. Over $100,000 more in other outlays has been poured into the century-old derelict building barged here from Victoria, B.C. in 2017.

As we’ve reported, city council had in hand the equivalent of a feasibility study — a pro forma — that showed the project would default within two years of securing financing. The project’s cost estimates had been derided as “bogus” by the president of Homeward Bound, the organization that was going to complete the project. Costs were lowballed in repeated efforts to hook the city and taxpayers, and then extract more from them as the project demanded more and more investment… until the costs of finishing it became utterly prohibitive and the project was abandoned.

In its push for a new pool, the city is again being offered a questionable feasibility study. The consultant leading the effort, Opsis Architecture of Portland, Oregon, stands to secure a lucrative contract if the project moves forward.

Every member of the steering committee wants to see a new pool built. There is no one outside the loop providing critical, objective analysis. There is no “red team/blue team” constructive give-and-take to drag into the open all the possible weaknesses and flaws in the work being done by Opsis and Ballard*King. The city and the aquatic center steering committee are going with only one estimate, the estimate that suits their agenda.

The flawed feasibility study comparing Port Townsend’s cost of living to Pennsylvania and reaching absurd extrapolations from statistical data, while also missing the Cape George pool and placing Port Ludlow’s pools in Kitsap County — that study has been in the steering committee’s hands for months. Apparently no one read beyond the numbers they selected to pitch to the public to see how the study may be seriously flawed. They have no reason to critique the feasibility study on which they are building their case for higher taxes.

No one on the steering committee apparently was troubled by the fact that the feasibility study relies only on hypothetical numbers and did not bother to consider the real-world costs of the nearby Shore aquatic center. The Olympic YMCA holds a seat on the steering committee. They could provide real-world data from the Sequim YMCA to show how much it costs to run a larger facility. That does not seem to have been done.

Taxpayers are being asked to buy into a massively expensive-to-build, expensive-to-operate amenity solely on the basis of hypothetical numbers.

Ballard*King has already given itself an out. They do not guarantee that they got any of their cost estimates right. Proceed at your own risk, they say.

Ballard*King disclaimer of responsibility for any inaccuracies or omissions in their cost projections

Taxpayers won’t have such an easy out. Once they bite, there’s no getting off the hook.

by Jim Scarantino | Aug 25, 2023 | General

Self-sufficient, profitable, a benefit to the community. That can be the future of the Port Townsend golf course, says the city’s consultant in a May 24, 2023 report that has started receiving serious consideration only within the past week or so.

The city’s consultant says the golf course can be turned around, double its revenue in four years and actually produce income for the city. Why in all the furor at city council meetings over the golf course’s future have we not heard about this consultant’s optimism and pragmatic plan of action?

David Hein, a golf course professional with more than 40 years experience managing golf course operations, maintenance, and business operations, was hired by the city as part of its “Envisioning the Port Townsend Golf Course” project, which needed “an updated evaluation … to accurately assess and understand the current status” of the golf course, including “a thorough review of the existing conditions and factors that have impacted the financial performance of the golf course over the past 5 years under the current Lessor/Lessee agreement.”

He concluded:

“Port Townsend has a very manageable asset in the golf course that could one day in the near future be a self-sufficient and valuable asset to the community. With the correct lease and management structure in place along with an operating plan and appropriate oversight, the Port Townsend Golf Course can support the golf and recreation needs of the immediate community as well as those visiting Port Townsend.”

He departs from an early assessment of the golf course by the National Golf Foundation. He does not see a need to invest the nearly $1.3 million in capital improvements the NGF recommended. He identifies as the first priority evaluating, repairing and improving the greens and irrigation system, with a starting budget of $150,000. That may seem like a lot for a cash-strapped city that is heading over a financial cliff.

But Hein’s estimate of a budget to repair and improve the greens — the critical feature of any golf course — is less than it is spending on “public engagement.” Carrie Hite, the contract employee given the title of Parks and Recreation Strategy Director is being paid $130,000 to lead the push to remake the golf course and put a tax measure on the ballot to fund a new aquatic center. She is being paid more than the city pays engineers and police officers. Groundswell Landscape Architecture, the firm participating in public engagement and drafting proposals for a golf course remake has a contract costing the city at least $125,000. Their combined $255,000, which has produced not one golf course improvement, is significantly more than Hein’s first step in getting the golf course to where it is self-sufficient and shares profits with the city.

The rest of his priority items — landscaping, equipment repair and acquisition, and clubhouse improvements — would require expenditures of $165,000, for a total of $315,000.

Hein’s total projected expenditures come in well below the $4.4 million required for the so-called “hybrid plan” presented to city council by the Groundswell Landscape Architecture — a huge sum the city does not have.

Hein recommends raising greens fees and expanding food and beverage operations. He sees ways to generate additional income from facilities, while also accommodating community interest in using the course for activities other than golf. Some holes might need to be relocated, buildings need to be cleaned out, management has to up its game. He does not see any financial viability for golfing if the course is reduced to an executive or par 3 course.

“I don’t foresee,” Hein writes, “a scenario where the golf course is materially reduced in size and scope that would accommodate all of the needs of the community and still attract golfers that would pay the required green fees to cover minimal capital improvements and the maintenance expense of the property.”

To reach his conclusions he examined the grounds and its buildings, even basements, which he believes can be converted into income-generating meeting and event spaces. He interviewed current management and golfers, and also contacted comparable 9-hole courses in Washington and obtained financial information from them for points of comparison.

Golf course supporters are encouraged by Hein’s report and have been crafting proposals to the city to implement his ideas so that the city need not subsidize operations and maintenance, as it does now, and will receive a percentage of gross receipts.

Hein’s 23-page report can be read in full at this link.

The city council is scheduled to tour the golf course and Mountain View commons on Monday, August 28, 2023 at 6pm with discussion to follow.

by Jim Scarantino | Aug 24, 2023 | General

The closer you look, the more problematic a new Port Townsend aquatic center appears. Operating costs would greatly exceed initial projections, according to the feasibility study prepared to boost the city’s promotion of a new aquatic/fitness center. The estimated annual operating expenditure of almost $2.1 million is more than twice the cost once projected by the city’s Sustainability Task Force and more than six times current operating costs for Mountain View pool.

To have any hope of avoiding financial failure, the new aquatic center would have to generate revenues as much as seventeen times greater than current operations, and hit that mark as soon the second year of operation.

And still a new P.T. aquatic center would run annual deficits of around $400,000.

Its projected operating costs would be greater than those of the Sequim YMCA and the Shore Aquatic Center in Port Angeles, and yet its revenue would be less.

These are just a few of the red flags that abound in the feasibility study for a new $38-$53 million aquatic/fitness center for Port Townsend. I discussed some of the problems with this document in “Drowning in Red Ink: Mountain View Pool and Proposed Aquatic Center.” Here I will delve deeper into why this “feasibility study” is a clanging alarm bell that should stop any responsible and prudent decision maker in her tracks.

A View of Port Townsend from the Rocky Mountains

The feasibility study was prepared for the city and its aquatic center steering committee by Ballard King & Associates of Highland Park, Colorado. They did not conduct any market research in and around Port Townsend or the rest of the county. Based on their report, it’s easy to conclude that they’ve never even been here. Their 69-page analysis exclusively uses census data and other exogenous statistical information, then extrapolates those statistics to our area.

They required pages of data, charts and graphs to reach the conclusion that we are an unusually old, childless and poor community, something we already know too well. Yet, despite heavy doses of data on demographics and economic conditions, they manage to say not one word about what is recognized here as our number one problem: our affordable housing crisis.

Anybody who had spent a little time on the ground here would know that our affordable housing crisis is driving demographics and economic challenges. It pushes young people and families away, and deprives employers of workers, depressing economic activity and stifling growth. Yet, not a peep about our biggest problem from these consultants in the picture they paint of Port Townsend’s population, economy and culture. Addressing that towering problem would push the pool way down the priority list of our immediate needs, and leave little money for the costly amenity of a new aquatic/fitness center.

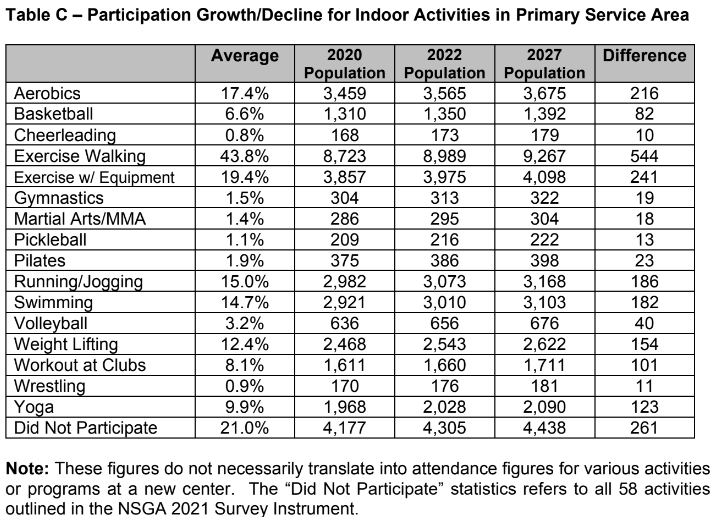

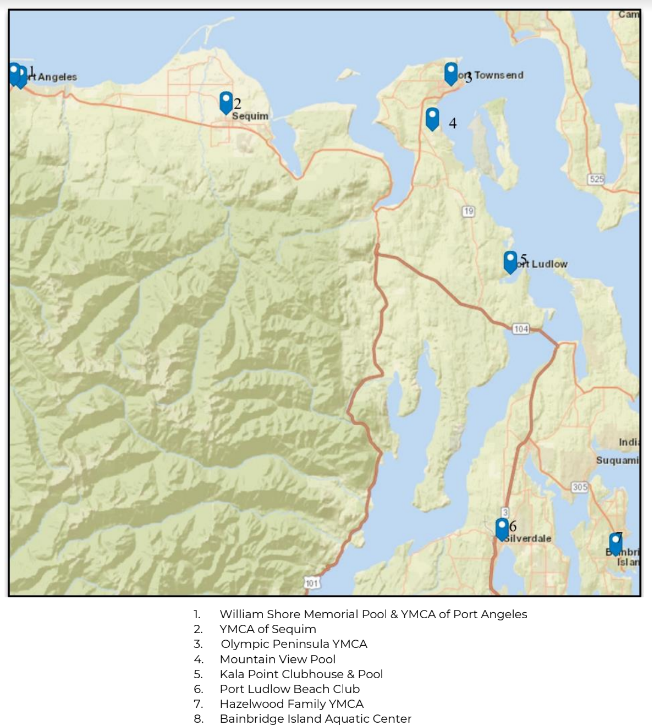

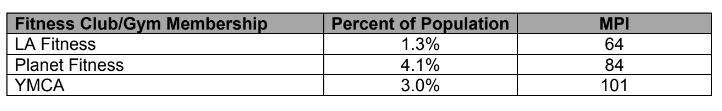

Some of Ballard King’s statistical extrapolation produced manifestly absurd results, such as concluding that in 2022 the Port Townsend area likely had 1,305 people engaged in basketball, 173 adults participating in cheerleading, and 313 adults doing gymnastics. Other absurdities riddle their computations.

At the same time that they were crunching numbers to tell us how our community recreates and exercises, they ignored bicycling completely. Notice there is no entry for biking in the above table. Yet, we have one of the premier biking trails in the nation in the Olympic Discovery Trail and the gem of the Larry Scott Trail running from the Boat Haven to Four Corners. Those trails see heavy bicycle use every day, as do our roads and streets. But, again, not a peep from consultants sitting at their desks in Colorado trying to guess how we spend our time and stay fit.

They purported to exhaustively survey existing swimming pools in the area. But somehow they missed the fact that Cape George has its own pool and they placed the Mountain View Pool at Kala Point. Then they put the Kala Point pool in Port Ludlow. The Port Ludlow pools they relocated to Silverdale. This map also indicates two pools in Port Angeles, when there is only one, the William Shore Aquatic Center.

Map of area pools from page 41 of Ballard King feasibility study.

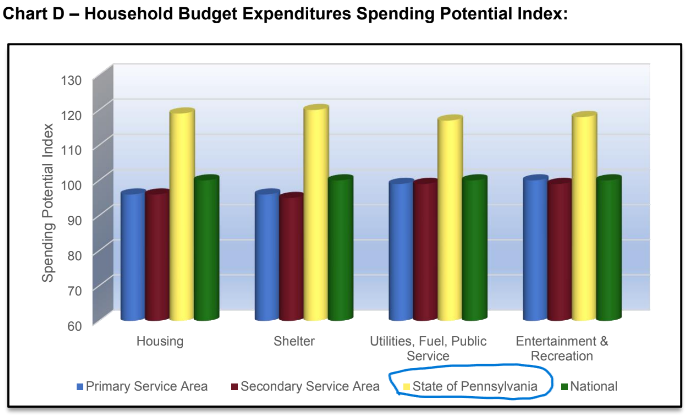

So detached are they from reality in Port Townsend, that on page 13 the Colorado consultants compared us to the State of Pennsylvania. One has to wonder if their report mixed us up with work they were doing for a community in the Keystone State instead of on the Quimper Peninsula, and where else in their report they confused us with other communities. This following graph, by the way, was used to make the case that our community is capable of spending quite a bit more money on recreational activities because the level of our expenditures for necessities — such as our very affordable housing — is below the national level and below that of… Pennsylvania(?)

The “primary service area” in this graph is Port Townsend, Cape George, Discovery Bay, the Tri-Area, Kala Point and Marrowstone; the “secondary service area” is everything in Jefferson County to the south of Chimacum.

Ballard King & Associates of Highland Park, Colorado, also concluded that over a thousand residents around Port Townsend and from the south county go to Planet Fitness and LA Fitness.

Table from page 30 of Ballard King report showing percentage of population they claim belong to fitness clubs.

The percentages in this table apply to the “primary service area” around Port Townsend. Ballard King estimated the population of that area at 21,551, meaning they believe that in and around Port Townsend, 884 people (4.1% of the population) patronize Planet Fitness and 280 (1.3% of the population) go to LA Fitness. There is, of course, neither a Planet Fitness nor an LA Fitness in Jefferson County. The nearest Planet Fitness would require a ferry ride to Oak Harbor or a drive to Bremerton. There are no LA Fitness outlets on this side of Puget Sound.

But there are two fine full-service gyms, Port Townsend Athletic Club and Evergreen Fitness. Ballard King didn’t bother to inquire as to the membership and usage of those facilities.

How much were they paid to churn this stuff out?

Risky Business

Several versions of a future aquatic center have been proposed: the “basic” model (pool only); the “basic plus gym”; and the Full Monty, a large swimming facility with several pools, gym, exercise rooms, meeting rooms, etc. — something on the scale of a large urban YMCA. Ballard King projected that the annual operating costs of the Full Monty would be nearly $2.1 million, with revenues of about $1.7 million and a deficit requiring public subsidy of about $350,000.

The subsidy for any aquatic/fitness short of a Full Monty would be somewhat higher because it would have fewer profit centers, e.g., weight room, yoga studio, etc. As I reported in my first article on this feasibility study, Ballard King recognizes that the many private gym and exercise studios existing in our community already, from full service gyms, to yoga and pilates studios, pose a “challenge” for the financial success of an aquatic/fitness competitor.

Herb Cook, a current Director and Past President of the Olympic YMCA, weighed in on the financial feasibility of aquatic centers in a Nextdoor comment on this issue. He wrote that the Sequim YMCA in 2019 (the last year before the pandemic lockdowns) had “more than 3,000 membership units (family and single) and 6,000 total members. Total revenue was slightly less than $2.2 million, total expenses slightly more than $1.8 million, net operating surplus more than $300,000.”

The Sequim YMCA is a Full Monty and then some. It offers a “six lane lap pool, a shallow family pool, hot tub, dry sauna, gymnasium, racquetball courts and wellness area.” It also offers basketball and volleyball and personal training and a steam room.

6,000 total members, 3,000 “membership units” make the Sequim YMCA feasible, according to Cook. Ballard King’s projections for the number of individual “membership units” for a Port Townsend aquatic/fitness center don’t come close. They project only 1,435 purchases of monthly and annual passes, 485 ten-visit pass sales, 55 daily passes per month.

The Sequim YMCA’s financial picture is the opposite of what Ballard King projects for a potential full-scale PT aquatic/fitness center. Where the Sequim YMCA brought in $2.2 million in revenue, PT’s top model is projected to bring in $1.7 million. On the expense side, PT’s projected operating costs would be almost $2.1 million versus just over $1.8 million for the Sequim YMCA. The amount of the projected PT aquatic/fitness center’s loss would be almost what the Sequim YMCA has seen as an operating surplus.

Proponents of a new PT aquatic center like to point to the William Shore Aquatic Center in Port Angeles. In my prior report, I showed that the projected admission fees for a new PT facility would be almost twice those charged at Shore. The Shore center relies heavily on property taxes to cover the difference between its operating costs and earned revenues.

Shore was built in the same era as the Mountain View pool and has undergone much maintenance, renovations, upgrades and expansions. It is now a very modern, attractive facility with several aquatic recreation offerings and a few “dry land” programs like yoga and personal fitness classes. It is situated in a younger community with a population more than twice the size of Port Townsend’s.

Yet it still requires a public subsidy of about $1.7 million annually, according to its 2022 budget. Those funds are collected through property taxes imposed by a metropolitan park district.

The Shore center’s 2022 budgeted operating costs were $1,622,715. This is a number generated with years of learning from actually operating the facility. The Ballard King projections for the comparable PT facility are $1,268,557, significantly below what the Shore center has found it needs to operate.

But we are supposed to believe that a PT aquatic/fitness center with higher operating costs, in a smaller community, with a very old and poor population, will need a subsidy only a quarter of the size of Shore’s? To hit that target, Ballard King assumes the aquatic/fitness center will enjoy a geometric jump in revenue that requires our old and poor population to pay admission fees about twice as high as those charged at the Shore Aquatic Center.

At least Ballard King, on page 50, near the end of their study, tells us not to take their projections to the bank. They disclaim any guarantee that their numbers may be relied upon fully. Do so at your own risk.

We Can Do That

No engineering analysis of what it would cost to upgrade and/or keep the Mountain View pool going as it is currently built was conducted before the push for a new aquatic/fitness center became public. Carrie Hite, the city’s Director of Parks and Recreation Strategy, stated in an email that, “We have opted not to spend close to $100K on a current full systems and structural analysis.” I have seen nothing to suggest that the city sought competitive bids for such an analysis. Hite could be pulling that number out of the air.

A full systems analysis was done for the city in 2001 by The ORB Organization, architects-planners-engineers, of Redmond, Washington. That analysis concluded, “The existing pool is quite adequate for basic instruction, training and aerobics,” but was not suitable for competitive swimming or diving. ORB examined all aspects of the pool and concluded it could be upgraded to meet current code requirements for $167,714 and its life extended for another 30 years–to 2031–for $355,113.

The roof does require replacement. Hope Roofing of Port Townsend conducted an inspection that found significant leakage and structural issues, such as soft spots where it would be unsafe to stand. City council recently had the option of fixing the roof properly, with a long-lasting, multi-decade solution, at the cost of $1 million. It opted for a temporary membrane fix that will last only a few years.

Hite wrote in her email that, “Parts for the pool are not manufactured anymore, so the pool is one breakdown away from closure.” We have also heard this at the town halls from Opsis, the Portland, Oregon architectural firm responsible for the conceptual illustration at the top of this article. They claim that parts for Mountain View’s pumps and filters cannot be purchased, so the pool only has a few years left before it must be scrapped.

But that is not necessarily true.

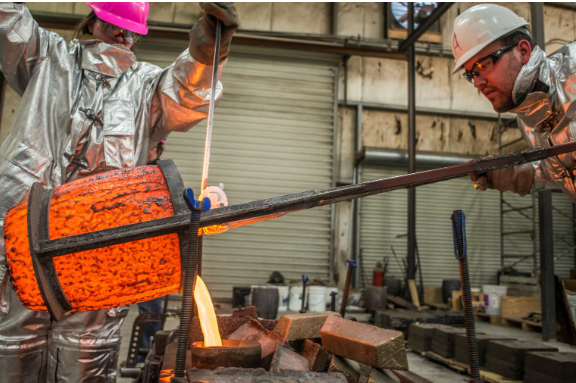

Workers at the Port Townsend Foundry

“We can fabricate anything for the pool,” Pete Langley, owner of the Port Townsend Foundry told me. His business is a custom and production nonferrous foundry in operation since 1983. They fabricate products from architectural castings to industrial castings to maritime hardware to antique replacements.

“I can build a pump from scratch. The equipment for a pool is not complicated. We can make anything the pool needs right here. We are a maker’s community,” Langley said. I was standing with him outside his operation in Glen Cove. He waved at other businesses that design and build sophisticated equipment and machinery. His “we” referred to his neighbors as well as his own highly skilled workers.

Langley is a current board member and the 2022 chairperson of the city’s Maritime Trades Association. “Look, we build boats. Some of the machinery in the mill is a hundred years old. The people in this town can fix a pool.”

Port Townsend’s annual Wooden Boat Festival is around the corner. The Port Townsend Foundry and other businesses here keep those magnificent classic boats going. They fabricate the hardware and parts “that are not manufactured anymore.” A pool’s simple filter and pumps are a lot less complicated and demanding than anything that heads out to the open ocean.

I have written Hite to ask if the city has consulted with Langley about fabricating locally any parts needed for the Mountain View pool. I am still awaiting a reply.

A Rigged Game

A decision was made by someone that a completely new aquatic center is going to be built. Opsis was brought in from Portland not to critically evaluate whether the existing pool could be renovated and upgraded, as the Shore Aquatic Center has been, but to promote a new pool through highly orchestrated “town halls.”

Opsis stands to land a lucrative architectural contract if the city gets the funding to build one of the versions of a new aquatic/fitness center.

At these “town halls” Opsis handed out colored circles with adhesive backing. Audience members were instructed to vote their preferences by sticking the dots on the artist conception of a new facility and selected features they liked (see our January 2023 article). Opsis did not make available any “No new aquatic center” option.

When questions were raised about the feasibility of addressing Mountain View’s needs, Opsis dismissed them out of hand. It was either go with one of the Opsis renderings of a new aquatic/fitness center or go without a pool — a stark choice that alarmed many of the frequent, elderly users of the pool who attended these “town halls.”

In the latest on-line survey people could vote only for which taxing method they like to raise the funds to pay for a new aquatic/fitness center. A “no new tax” option was not offered. At the last town hall held at Fort Worden on July 13, 2023, in response to a question from the audience Hite revealed that only about 150 people had been participating in the survey that was providing direction to the process.

“The Mountain View pool is nearing the end of its life,” has been the drum beat from Opsis and city manager John Mauro. That is an urban myth unproven by any engineering analysis. It is a talking point, and a talking point only, to drive people towards approving taxes to build a completely new, and vastly more expensive facility with implausible financial viability.

A responsible approach would have been to do a full engineering systems analysis at the beginning of this process. Instead, someone in City Hall launched a campaign to go after $38-53 million in new taxes to build a new aquatic/fitness center on a scale seen in larger urban areas.

The first installment was the $175,000 paid to Opsis for its drawings and “town halls” and whatever was paid to Ballard King for their “feasibility study.” Throw in the six-figure salary being paid to contract employee Hite whose job as “Strategy Director” is promoting the new pool (and a remake of the golf course), and all the time spent by city employees and others on the town halls and behind-the-scenes meetings to secure taxes for a new pool. We will never know what could have been accomplished with those funds if instead they had been invested in addressing Mountain View’s needs and finding a way to keep what we’ve got as they did in Port Angeles… and also Anacortes, by the way.

Opsis presents its final recommendation to City Council on September 5, 2023. Hite has said the goal is to get a proposed tax measure on a special election ballot in February 2024. The two tax measures under consideration are a property tax hike that would hit properties in Cape George, Discovery Bay, Irondale, Port Hadlock and Chimacum (and areas to the south), Marrowstone Island, and Kala Point, as well as Port Townsend. The other tax measure being considered is a county-wide sales tax.